Trust & Will Attorney, Venice Florida

Trust and Will Attorney in Venice, Florida

Protecting Your Family, Your Future, and Your Legacy

Planning for the future is one of the most important steps you can take for your loved ones. A Trust and Will Attorney in Venice, Florida helps you create a solid plan that ensures your wishes are honored, your assets are protected, and your family avoids unnecessary legal challenges.

Whether you’re preparing your first estate plan or updating an existing one, working with an experienced attorney ensures your documents comply with Florida law, reflect your personal values, and provide peace of mind for years to come.

Why You Need a Trust and Will Attorney

While online forms may seem convenient, estate planning in Florida involves unique statutes and complex property laws. Even small mistakes in wording, witness requirements, or trust funding can cause significant legal problems later.

A local Trust and Will Attorney provides professional guidance to:

Draft wills and trusts that comply with Florida’s Trust Code (Chapter 736) and Probate Code (Chapter 732).

Ensure your assets are transferred efficiently and privately.

Avoid probate delays, tax burdens, and family disputes.

Plan for incapacity, guardianship, and healthcare decisions.

An attorney who understands both estate law and Sarasota County regulations can help you build a comprehensive plan tailored to your financial and family goals.

Understanding Wills in Florida

A Last Will and Testament is the cornerstone of any estate plan. It specifies how your property will be distributed after your passing and allows you to name guardians for minor children.

Key Features of a Valid Will in Florida:

Must be in writing and signed by the testator (the person making the will).

Requires two witnesses to sign in the presence of the testator.

Must be executed with clear testamentary intent and mental capacity.

Your will can:

Distribute personal property and real estate.

Name an executor (known in Florida as a personal representative).

Designate guardians for dependents.

Direct specific gifts or charitable contributions.

However, a will does not avoid probate. For this reason, most families in Venice, Nokomis, and Englewood choose to pair their will with a revocable living trust to streamline estate administration.

The Role of Trusts in Florida Estate Planning

A trust is a legal arrangement where a trustee manages property for the benefit of one or more beneficiaries. Trusts offer greater privacy, control, and flexibility than wills alone.

Types of Trusts Commonly Used in Florida:

1. Revocable Living Trust

Allows you to manage your assets during your lifetime and pass them directly to your heirs without probate. You can amend or revoke it anytime while competent.

2. Irrevocable Trust

Offers enhanced asset protection and potential tax advantages but cannot be easily changed once created.

3. Special Needs Trust

Provides financial support to a disabled loved one without disqualifying them from government benefits.

4. Asset Protection Trust

Shields assets from creditors and lawsuits while preserving wealth for your beneficiaries.

5. Testamentary Trust

Established through a will and activated only after death, often used for minor children or dependents.

By combining wills and trusts, you can ensure both efficiency and control—avoiding probate, minimizing taxes, and protecting your family’s inheritance.

Benefits of Working With a Trust and Will Attorney in Venice

Hiring a local attorney ensures your estate plan reflects Florida’s specific laws and exemptions. Some of the key benefits include:

Personalized Planning: Every family is unique. Your attorney will tailor your trust and will to your exact goals.

Avoiding Probate: Proper trust funding and documentation prevent costly court involvement.

Protection From Disputes: A well-drafted estate plan reduces the likelihood of will contests or family conflicts.

Tax and Asset Preservation: Strategic trust design can reduce estate and income taxes while protecting your property from creditors.

Peace of Mind: You’ll know that your documents are valid, enforceable, and designed to protect your family’s long-term security.

Florida Legal Requirements for Trusts and Wills

Both trusts and wills in Florida must meet precise legal standards to be enforceable.

For Wills:

Must comply with Florida Statutes Chapter 732.

Must be signed by the testator and witnessed by two individuals.

Handwritten or oral wills are generally invalid in Florida.

For Trusts:

Governed by Florida Statutes Chapter 736.

Must have a clear purpose, identified beneficiaries, and properly titled assets.

Real estate and financial accounts must be re-titled in the name of the trust to avoid probate.

An attorney ensures your plan meets these formalities and aligns with Florida’s homestead, spousal, and elective share laws—which often surprise newcomers relocating to Sarasota County.

Estate Planning for Venice, Florida Residents

Venice’s population includes retirees, young families, and small business owners—all of whom benefit from customized estate planning.

For retirees, trusts help simplify multi-state property transfers and coordinate with out-of-state assets. For parents, wills and guardianship designations protect minor children. And for business owners, succession planning ensures the company remains operational and financially stable.

By working with a local Trust and Will Attorney, you gain the advantage of area-specific knowledge, such as Sarasota County probate court procedures, local property titling practices, and Florida’s unique asset protection exemptions.

Common Misconceptions About Estate Planning

Myth 1: “I don’t need a will or trust because I’m not wealthy.”

Estate planning is about control and protection, not just wealth.Myth 2: “My spouse automatically gets everything.”

Florida’s inheritance laws can be complex—especially for blended families.Myth 3: “I can just use an online form.”

Generic documents often fail Florida’s strict execution requirements and can lead to costly disputes.

Frequently Asked Questions (FAQ)

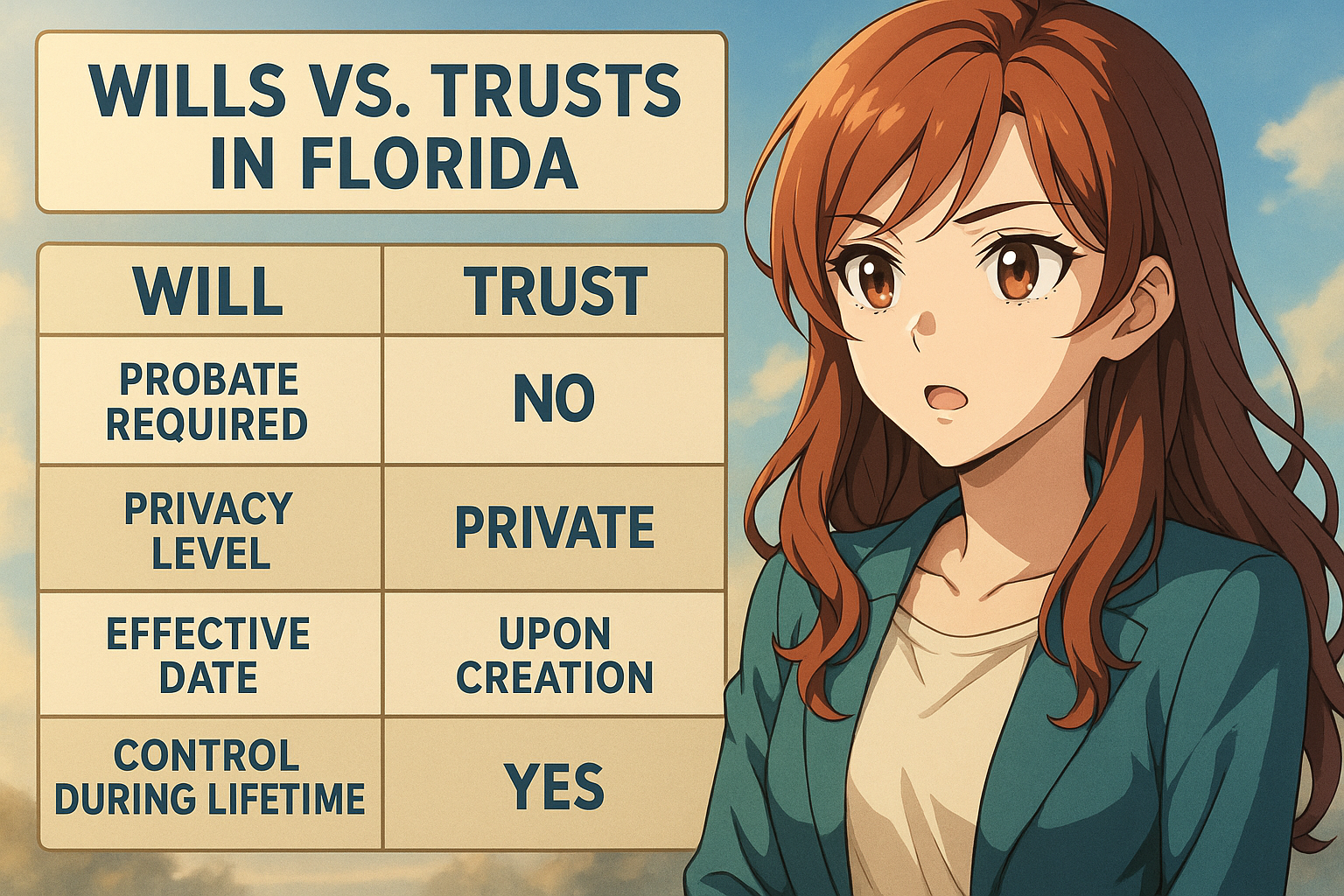

1. What’s the difference between a will and a trust in Florida?

A will takes effect after death and requires probate, while a trust takes effect immediately and allows assets to transfer privately and efficiently.

2. Do I need both a trust and a will?

Yes. A trust manages most assets, but a “pour-over will” ensures any property not titled in the trust transfers to it after death.

3. How often should I update my estate plan?

Review your documents every 3–5 years or after major life changes like marriage, relocation, or inheritance.

4. Can my trust protect assets from creditors?

A revocable trust does not offer asset protection, but certain irrevocable trusts can.

5. What happens if I don’t have a will in Florida?

Your estate will be distributed under Florida’s intestate succession laws, which may not align with your wishes.

6. How much does it cost to hire a Trust and Will Attorney in Venice?

Fees vary depending on complexity, but most firms offer flat-rate packages or affordable consultations for basic estate plans.

7. Is probate always required in Florida?

Not necessarily. Properly funded trusts and certain exempt assets can bypass probate entirely.

Take the Next Step

Creating a trust or will is more than a legal process—it’s an act of love and responsibility. It ensures your legacy lives on and your family remains protected from unnecessary stress or conflict.

If you’re ready to safeguard your future with a comprehensive estate plan, consult a Trust and Will Attorney in Venice, Florida who understands both state law and your family’s unique priorities.

📍 EstatePlanningVeniceFlorida.com

📧 office@EstatePlanningVeniceFlorida.com

Serving Venice, Nokomis, Osprey, Englewood, and Sarasota County